what is the tax rate in tulsa ok

The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022. The total sales tax rate in any given location can be broken down into state county city and special district rates.

The Plaza Shopping Center Price Edwards And Company

State of Oklahoma 45.

. This is the total of state and county sales tax rates. By mail Make checks payable to the City of Tulsa and mail to the City of Tulsa Lodging Tax Processing Center 8839 North Cedar Avenue 212 Fresno CA 93720. This includes the rates on the state county city and special levels.

However left to the county are evaluating property mailing billings taking in the levies engaging in. The latest sales tax rate for Tulsa OK. The Oklahoma state sales tax rate is currently 45.

For the 2021 tax year Oklahomas top income tax rate is 5. That puts Oklahomas top income tax rate in the bottom half of all states. What is the sales tax rate in Tulsa OK.

Nearby Recently Sold Homes. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state.

How much is tax by the dollar in Tulsa Oklahoma. Does Tulsa have income tax. For the 2020 tax year Oklahomas top income tax rate is 5.

The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. City 365. The Sooner States property taxes are also.

Sales Tax in Tulsa. Nearby homes similar to 1218 S Yale Ave have recently sold between 185K to 335K at an average of 150 per square foot. What is the sales tax rate in Claremore OK.

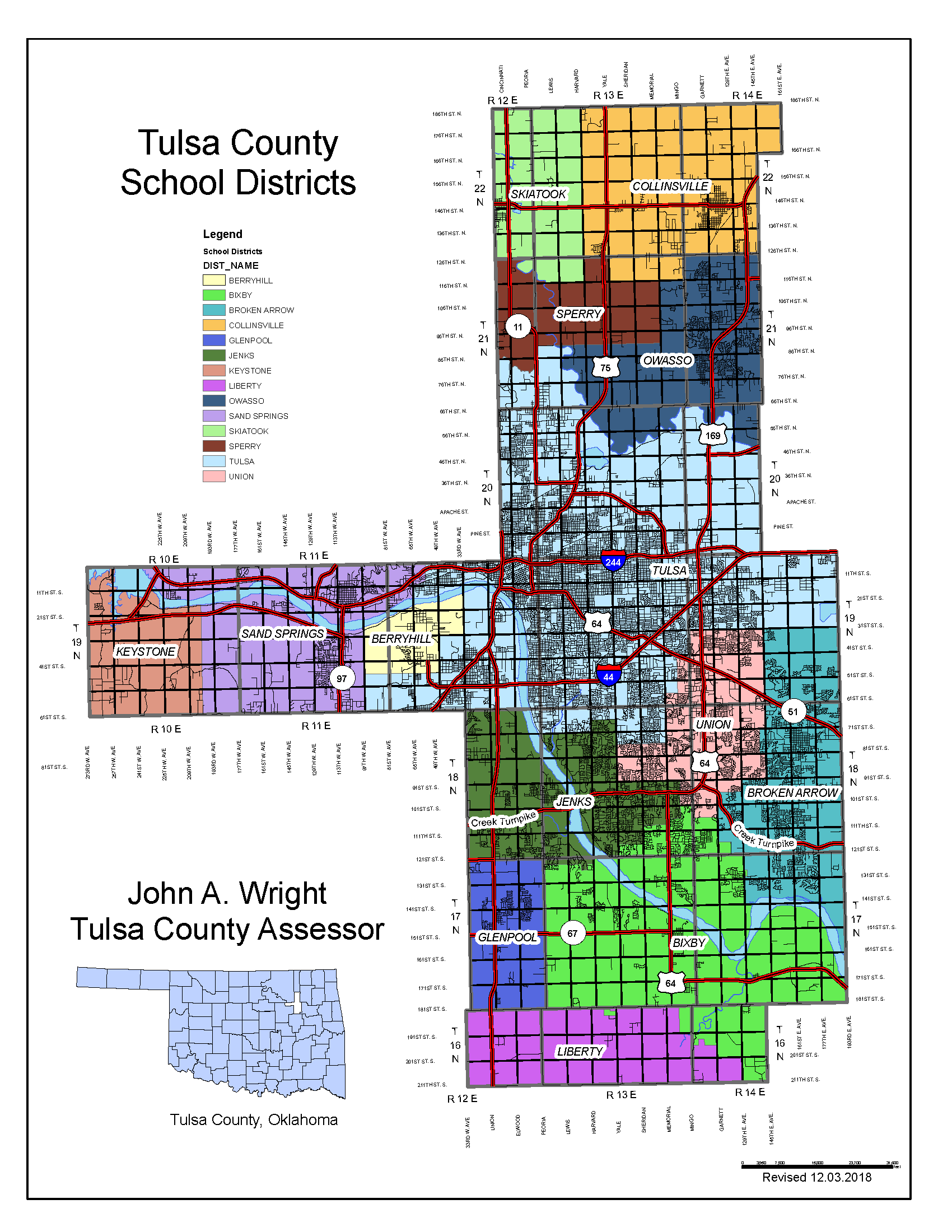

The average cumulative sales tax rate in Tulsa Oklahoma is 831. SOLD JUN 10 2022. Tulsa has parts of it located within Creek County Osage.

Detailed Oklahoma state income tax rates and brackets are available on this page. The minimum combined 2022 sales tax rate for Tulsa Oklahoma is. The median property tax also known as real estate tax in Tulsa County is 134400 per year based on a median home value of 12620000 and a median effective property tax rate of.

Online You will need. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is 852. The countys average effective property tax rate of 113 is.

Nearby Recently Sold Homes. Tulsa County collects on average 106 of a propertys assessed. The total sales tax rate charged within.

2020 rates included for use while preparing your income tax deduction. Tulsa County 0367. This rate includes any state county city and local sales taxes.

Inside the City limits. Nearby homes similar to 1902 W Cameron St have recently sold between 95K to 356K at an average of 135 per square foot. While maintaining constitutional limitations mandated by law the city sets tax rates.

State of Oklahoma 45. This is the total of state county and city sales tax rates. The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365 Tulsa tax.

The Oklahoma sales tax rate is currently. 2483 lower than the maximum sales tax in OK. Oklahoma has a 45 sales tax and Tulsa County collects an additional.

Cutting The Top Income Tax Rate Who Benefits Oklahoma Policy Institute

Taxes Broken Arrow Ok Economic Development

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

7311 S College Pl Tulsa Ok 74136 Realtor Com

Plan To Raise Oklahoma S Sales Tax Has Supporters Detractors

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Concerts Festivals Tours In October 2022 Seatgeek

Tulsa Ok Tulsa Central Hotel Extended Stay America

Oklahoma Tulsa Adds Canoo Plant To Its Ev Credentials Site Selection Magazine

Victorian Lady Tulsa Ok Room Rates

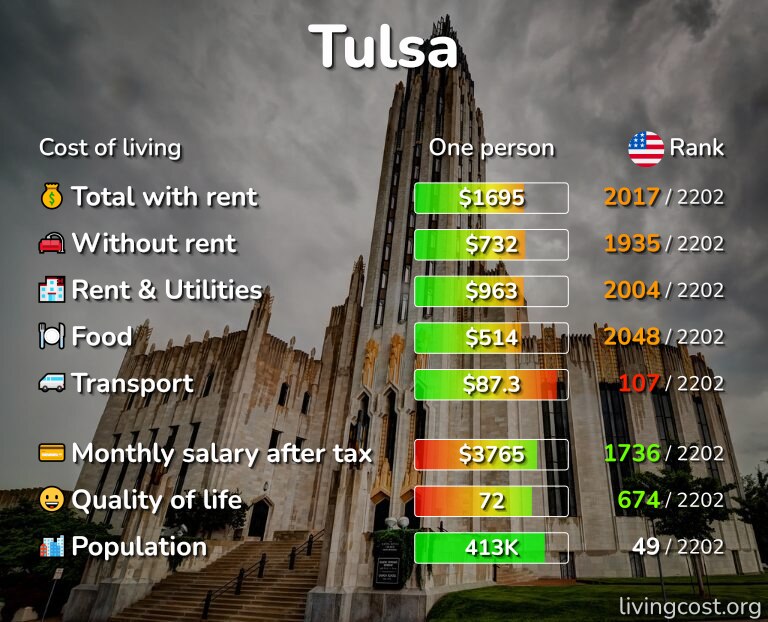

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

10 Best Tax Relief Companies In Tulsa Ok Newson6 Reviews

Tulsa County Assessor Tax Estimator

Tulsa Ok Zingo Roller Coaster Bell S Amusement Park Std Size Postcard Repro Ebay

15 Areas In Tulsa To Find Great Investment Properties

Moving To Tulsa Here Are 14 Things To Know Extra Space Storage

/https://s3.amazonaws.com/lmbucket0/media/business/3SJU_Tulsa_OK_20220921212929_Ext_01.8361d0fe01f01c1987e590fbad4e71a232365914.jpg)